IRC 61-22 Restricted Executive Bonus Arrangement (REBA)

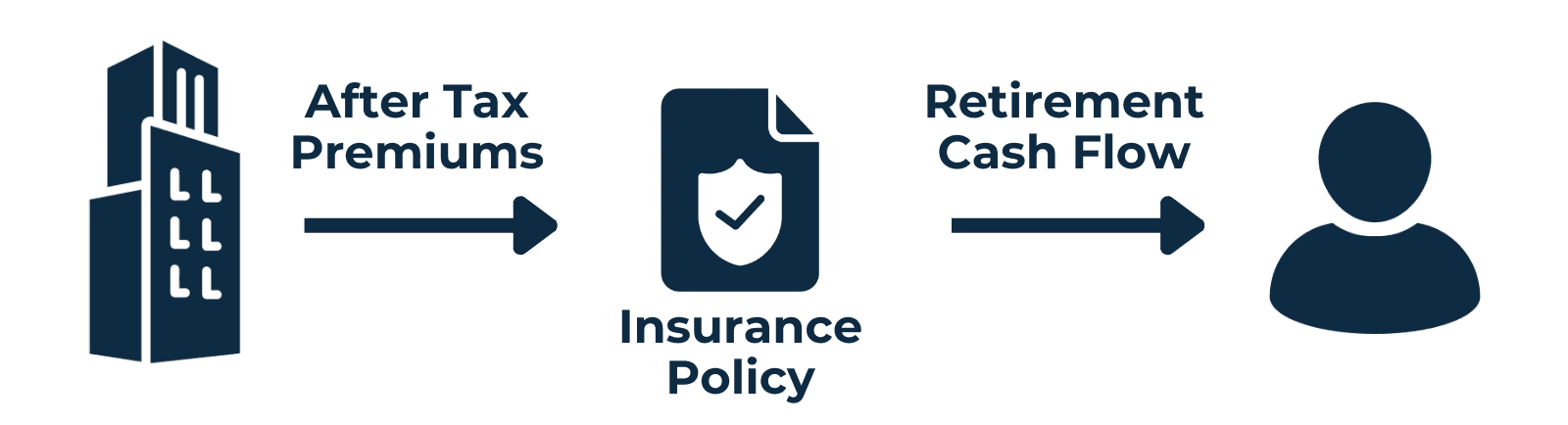

Under an Executive Bonus Arrangement, the organization pays a bonus to the executive which is then used to purchase a life insurance policy owned by and insuring the executive’s life, with a focus cash accumulation and retirement income. Once the funds are paid to the life insurance policy as a premium, they have growth potential and may be accessed without additional taxation via either withdrawals to basis or policy loans (this treatment is contingent upon the policy avoiding a modified endowment contract (“MEC”) designation).

Under a Restricted Executive Bonus Arrangement (REBA), the employer and executive execute a contract under which the employer restricts the executive from exercising most of the ownership rights under the life insurance policy, such as accessing cash values. As a result, the executive cannot access the life insurance cash values until i) vesting in the premium bonuses, ii) reaching an access date, or iii) working for the employer for a specified number of years. If the executive leaves before being fully vested, either the lesser of any unvested portion of the bonus or the policy’s cash value is paid back to the employer. This restriction results in creating “golden handcuffs”, which encourages loyalty and motivates key executives to grow productivity.

How It Works

The executive applies for and owns a life insurance policy. In conjunction with the purchase of the life insurance policy, two additional components must be incorporated into a REBA, i) the restriction of ownership rights endorsement filed with the insurance company and ii) the REBA Agreement.

Applicable

Regulations Sections 61-22, and 451.2 of the Internal Revenue Code (the “Code”) are the primary applicable governing sections of these arrangements.

Organization Perspective

From the organization’s perspective, payments made as premiums to the life insurance policy will be an expense and will not be recovered. The executive will own the life insurance policy, and the employer will not be a beneficiary of the policy in any way.

Key Considerations

Retention Value

Timing and Amount of Capital Requirements

Impact on Financial Statements

Flexibility

Plan Administration Requirements

Regulatory Environment

Taxation

Executive Perspective

Income (the bonuses that ultimately result in premiums) is taxed when received or when vesting occurs. The policy provides tax-deferred growth and tax-free access to the policy’s cash value in the future. In addition, the death benefit is allotted exclusively to the executive’s beneficiaries.